Managed by Pegasus Capital Advisors

The SCF Investment Fund is managed by Pegasus Capital Advisors, an established global private markets impact investment manager with an extensive network in infrastructure, energy, and waste. As the first traditional North American alternative asset manager accredited by the Green Climate Fund, Pegasus Capital Advisors is dedicated to fostering sustainable and inclusive growth while providing attractive returns for our investors. Founded in 1996 by Craig Cogut, Pegasus has invested over $2 billion across five private equity funds.

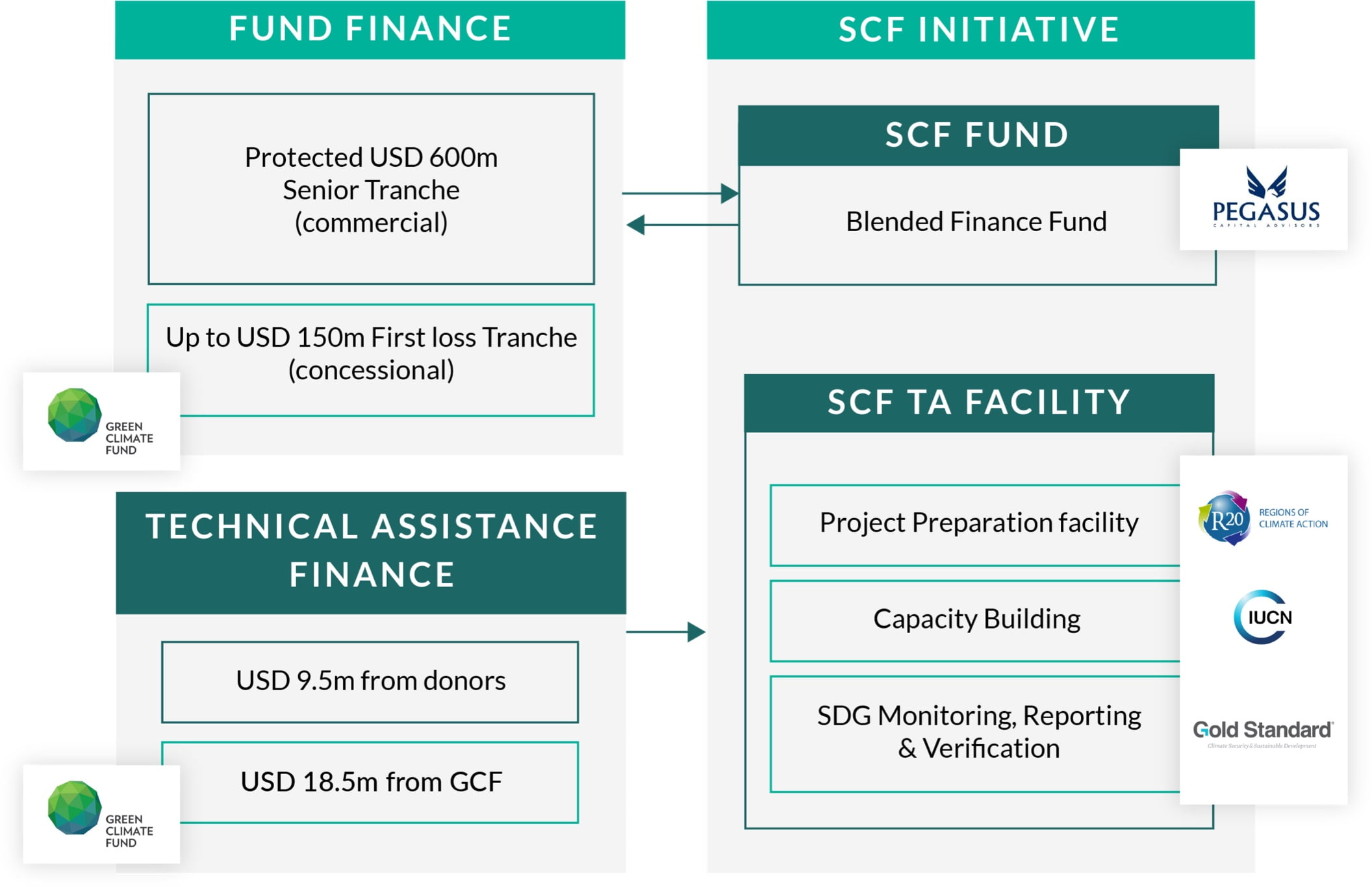

A blended finance initiative

The Green Climate Fund committed up to $150 million to the Investment Fund for a junior tranche which is intended to further de-risk investment, and help mobilize additional public and private capital that have limited access to opportunities with attractive risk-reward profiles in developing countries.

Diversified portfolio strategy that combines environmental, social, and financial performance

The SCF investment strategy aims to develop a geographically and sector-diversified portfolio of 15 to 25 scalable, commercial, and primarily greenfield projects across Latin America and the Caribbean, Asia, Africa, and the Mediterranean with measurable SDG impact. Pegasus seeks control-oriented infrastructure projects applying proven technologies and value creation through active ownership and sustainable stewardship.

Investments sectors

Sustainable Energy Solutions

- Solar photovoltaic farms

- Energy storage solutions

- Wind parks

- Biomass power plants

- Energy efficiency solutions

waste & water management

- Waste sorting, treatment, recycling

- Composting facilities

- Proven conversion technologies

- Water & Sanitation

urban development solutions

- Climate infra and urban transport

- Digital infrastructure

- Smart city development

- Sustainable tourism infrastructure

Sustainable agriculture

- Sustainable high value crop agriculture

- Integrated food and agri value chains

- Agriculture technology or agritech

- Controlled environment agriculture

Investments criteria

- Proven and growing local need for climate infrastructure

- Replicability and scalability of investments

- Ticket size of equity investments in the range of 5-75m USD

- Strong financial return

- Measurable climate impact

Certified Impact

Creating long-term value by considering the impact on the people and planet is the starting point of Pegasus’ investment philosophy. Pegasus selects investments individually and seeks measurable positive social, environmental, and economic impact. ESG and impact considerations are integrated throughout the entire investment cycle.

SCF will be the first SDG-certified fund compliant with Gold Standard Fund Requirements which reflect stakeholder inclusivity, impacts linked to SDGs with approved methodology, rigorous safeguards to avoid unintended negative effects accompanied by credible independent measurement and audit of impact outcomes.

SCF creates multiple sustainability co-benefits with specific targets, measurement and reporting for SDG 7 (affordable and clean energy), 8 (decent work and economic growth), 11 (sustainable cities and communities) and 13 (climate action) with key stakeholder involvement and “ownership” at the national and local levels.

Team

Craig Cogut

Founder, Chairman & CEO

David Cogut

Partner

Anuj Kamdar

Vice President

Daniela Gomez Ziga

Associate

Natalie Gartmann

ESG and Impact Manager

Nicolas Hasselbach

Operating Advisor

Parth Shah

Vice President

Ronen Gani

Operating Partner

Terry Tamminen

Operating Advisor

Tim Corfield

Operating Partner